nanny tax calculator uk 2020

Talk to a Specialist. This breaks down to 62 for Social Security and 145 for Medicare.

![]()

Nanny Payroll And Tax Experts Tax Calculator Nanny Matters

NannyMatters have provided professional nanny payroll services and expert tax advice for parents since 2002.

. New company providing payroll services and all required Revenue returns including PAYE modernisation for families who employ nannies or childminders in the UK. The complete candidate document package will be submitted to you following the placement. You can also use the HMRC calculator.

For a competitively priced annual fee we remove all the worry that can. The government have a maximum allowance of 045. This calculator will help you understand the total cost of employing a nanny and how much the nanny will take home.

Nanny tax calculator uk 2020 Wednesday June 22 2022 Edit. Please note that from August 2020 National Insurance nor Pensions contributions are reclaimable under the furlough scheme. Home Buy Now Tax.

The Nanny Tax Company has moved. Your Employer Members Area - exclusive to Nannytax - keeps everything in one place and enables you to easily inform us about any changes. Our new address is 110R South.

Were here to help. The Nanny Tax Calculator. How often is it paid.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023. Nannytax Payroll Services for UK Employers - Nannytax. A household employer is responsible to remit 765 of their workers gross wages in FICA taxes.

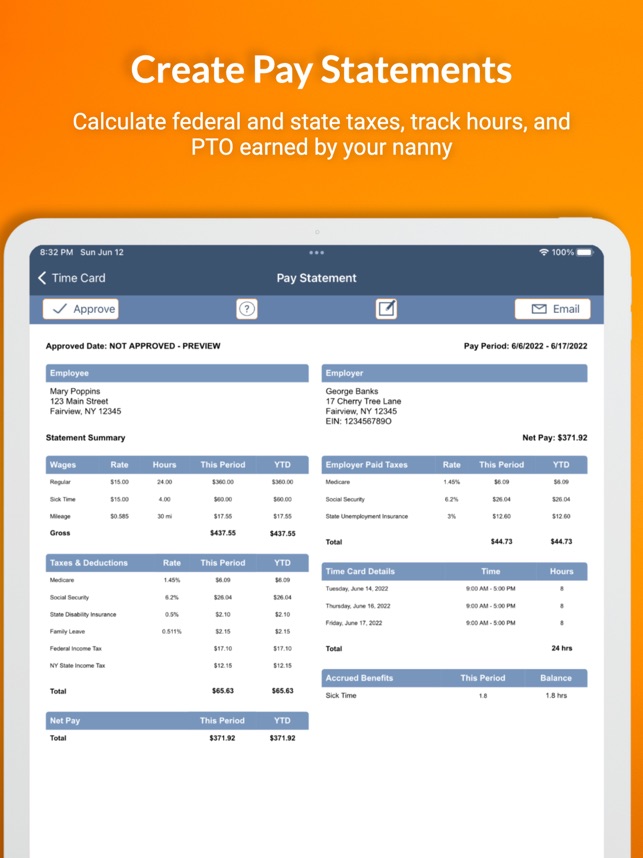

Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again. Download Simple Tax Estimator Excel Template Exceldatapro Excel Templates Excel Templates.

Cost Calculator for Nanny Employers. Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax. This tells you your take-home.

Nanny tax calculator uk 2020 Wednesday June 22 2022 Edit. Our experts are available to answer your questions about paying household employees. The 202021 tax calculator provides a full payroll salary and tax calculations for the 202021 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations.

Agreeing the appropriate mileage rate with your employee is an important part of their contract with you. The Nanny Tax Company has. The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee such as a nanny or senior caregiver.

Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding. Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer whether paying a nanny a senior care worker or other household. Fill in the salary.

Then print the pay stub right from the calculator.

Working Out Your Nanny S Tax Parent S Tax Table Tax Calculation

How Much Does A Nanny Cost Nanny Salary Index 21 22 Nannytax

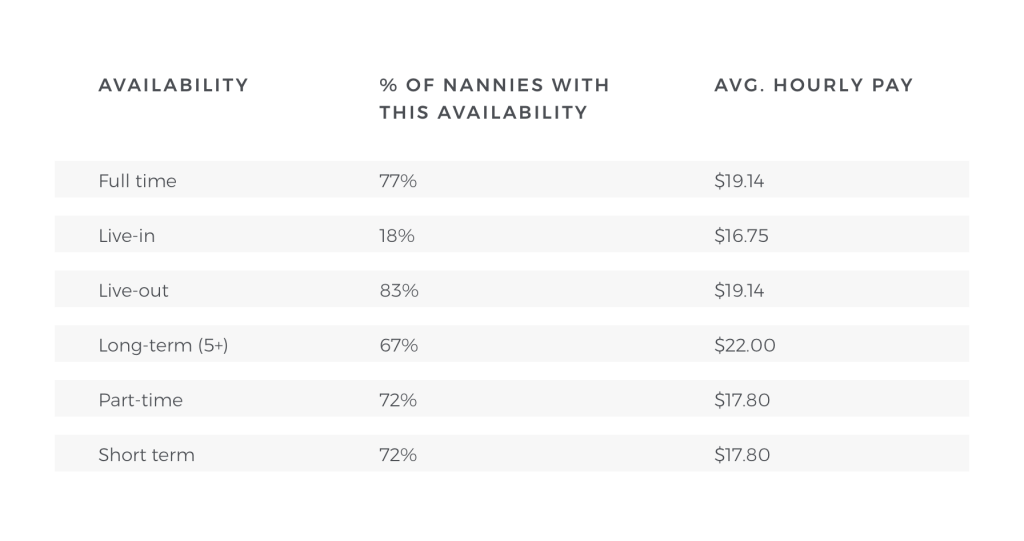

How Much Do I Pay A Nanny Nanny Lane

Nannytax Furlough Portal Hmrc Calculator

Nanny Tax Calculator Leading Nanny And Maternity Nurse Agency Uk London Mytamarin

Income Tax Calculator Find Out Your Take Home Pay Mse

W9 Vs 1099 Tax Forms What S The Difference Forbes Advisor

The Salary Calculator 2022 2023 Tax Calculator

Tax Nanny Payroll Employing A Nanny For The First Time

Parenting Babysitter Nanny And Infant Care Blog Nannypod

![]()

Income Tax Calculator 2022 United Kingdom Salary After Tax

Can I Afford A Nanny 7 Tips For Employing A Nanny Nannytax

Uk Salary Tax Calculator Uk Salary Tax Calculator

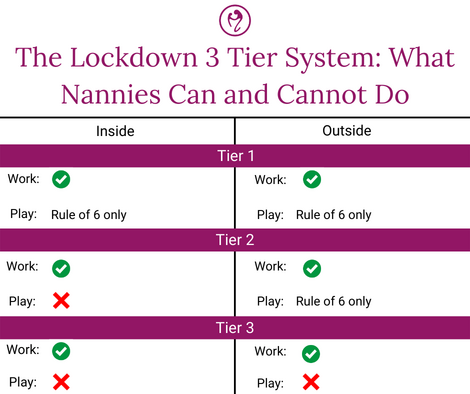

The Three Tier System What Are The Restrictions For Nannies Leading Nanny And Maternity Nurse Agency Uk London Mytamarin