do dealerships ask for proof of income

However if you only have a job letter some lenders may be more willing to finance you if you have good credit and have had a stable work history. To answer your question some dealerships will call your employer to verify your income and employment.

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

Do dealerships actually check income.

. These answers are incorrect especially Subhashs who sounds like real fun at a party. This is to make sure youre able to make the monthly payments. No the dealership wont call the IRS to confirm your income.

Ad Build Price Locate A Dealer In Your Area. How do car dealerships check your income. Most of the time if you have tier 1 credit theyll never ask for it.

Depending on how you earn your income you may need to provide various documents. So before you head to the dealership make sure you bring a paystub or bank statement. If you dont provide proof of income though you should plan to.

They base their decision entirely off your pay stubs 1099s or other income-based documents. SSNs are required by the patriot act but not to run your credit its for a system called OFAC office of foreign asset control which verifies your identity and makes sure you andor your bu. At this point you might be wondering how do banks verify income.

Proof of Income for Car Dealerships. My debt is due mainly to medical and some card trouble. When verifying income for auto loans lenders perform several steps.

Although the minimum income requirement varies by lender they typically want to see you make anywhere from 1500 to 2000 a month before taxes. Credit score This is the biggest one. This is so they can verify you have adequate income to pay your monthly payments on time ultimately protecting their own interests.

Proof of income. I have excellent auto credit though never missed or was late. Some buy here pay here dealerships will let you skip a down payment or may require a down payment as low as 500.

Yes is the short answer to whether car dealerships verify. Ch 7 Discharge 3122018. This can vary but 20 of the cars purchasing price is a good benchmark.

Answered on May 05 2021. Without a computer-generated check stub expect lenders to be hesitant to approve you for an auto loan with just a job letter. Cap One VentureX 30000 CapOne Savor 5300 Kohls 3000 Comenity MC 4900.

Dealer will only ask for proof of income if the bank requires it. As for the documents you need to bring in it depends on the type of work you do. But more realistically theyll ask for proof of income in the form of W-2s pay stubs or tax returns.

A dealership asking for pay stubs is a standard part of the auto loan application process. Most lenders like to see a down payment of at least 20. Anyway I applied for this truck online through toyota.

Car dealerships may ask to see your most recent three 3 months of Pay Stubs for income verification. They might call your employer if they cannot verify employment. If you have bad credit the lender will ask for proof of income and will have a minimum income requirement you must meet generally 1500 to 2000 a month pre-tax.

Find Your 2022 Nissan Now. Keep the loan amount small relative to your incomeexisting debt. Answer 1 of 10.

Drive A Nissan Car So Advanced Youll Feel Like Youre Driving The Future. Because auto lenders want to verify that you have a steady income to pay back the car loan or auto financing over time. Dealerships often require customers to provide proof of income especially if they have bad credit.

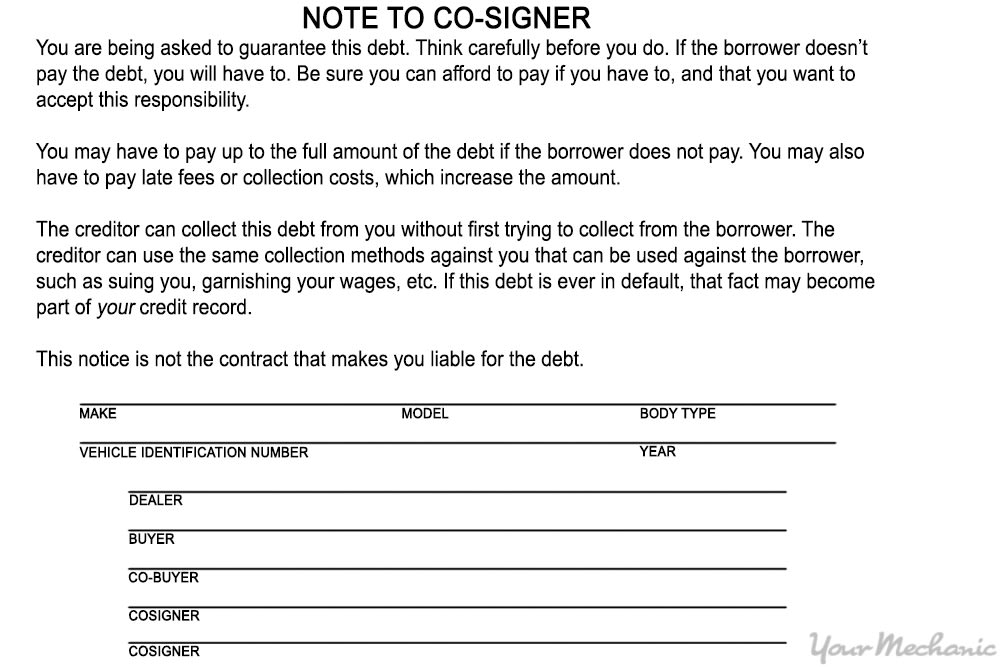

Even if asked the offer letter should suffice. If youre a W-2 employee and work full time you need to bring in a computer-generated copy of a pay stub from the. Most dealers do not underwrite auto loans but finance companies do.

For most W-2 employees banks verify income for auto loans quickly and smoothly. But if you have a non-traditional source of income or the bank has difficulty getting information from your employer the. To answer your question some dealerships will call your employer to verify your income and employment.

If your credit is good 680 with multiple trade lines and 24 months history and income makes sense they wont ask for verification. Asking what circumstances might prompt a car dealer finance company or bank to contact your employer to verify employment is a much better question that brings you closer to a real-life answer you can trust. Dont worry about it too much.

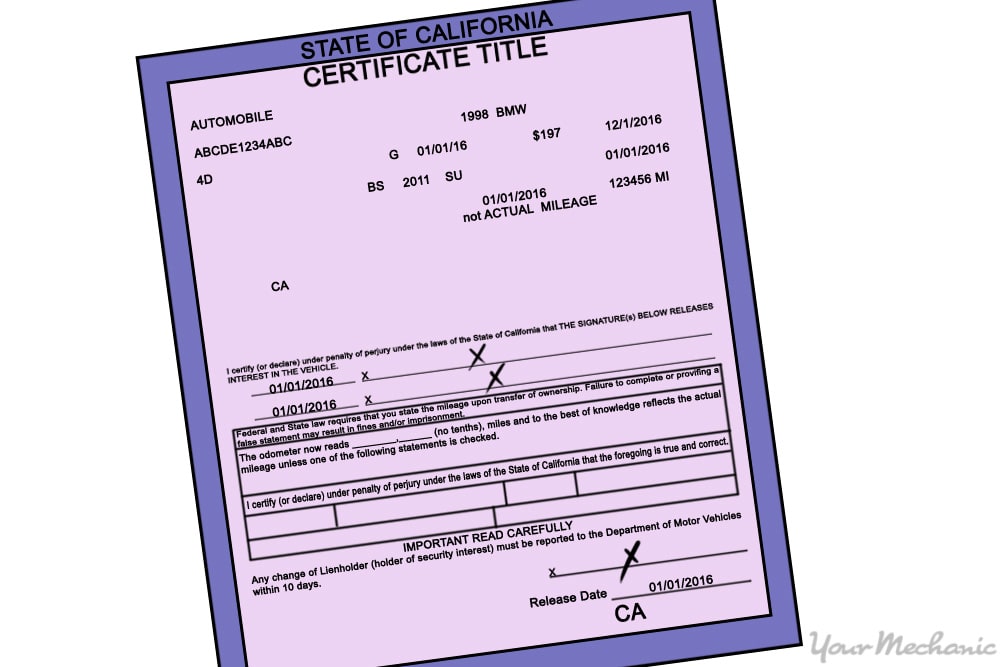

This is typical of all auto loans regardless of where you apply for financing. Ways to Prove Your Income. When you purchase a car with vehicle financing providing proof of income is a must.

Even the last 3 loans and 1 lease were without proof of income all after BK7 discharge. Whether or not you need to provide proof of income depends on four criteria. Do car dealerships ask for proof of income.

I have bad credit 550 and Im looking to finance a new truck. With a 790 score any dealer could pull that off. But more realistically theyll ask for proof of income in the form of W-2s pay stubs or tax returns.

TLDR Dealer wants proof of income and proof of residency isnt telling me if Im approved or not. The first step a lender might take is asking for your pay stubs. Dealerships typically need 3 months of pay stubs.

For the most part lenders question a job letter as proof of income.

Do Car Dealerships Verify Income Private Eyes Background Checks

Auto Dealers Verify Income Employment To Help Sell More Cars

Auto Dealers Verify Income Employment To Help Sell More Cars

Do Car Dealerships Verify Pay Stubs Quora

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

Ol9800 7 5 X 10 Editable Ftc As Is Buyers Guide Window Label Printable Form Online Labels For Sale Sign Labels

Automobile Financing For Canadian Dealerships Fairstone

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

Can A Car Dealership Ask For Paystubs Days After You Signed All Paperwork And Was Given The Car Quora

What Are Special Financing Dealerships

:max_bytes(150000):strip_icc()/car-dealer-showing-new-car-to-young-couple-in-showroom-590778115-fd7e5fcf72564de69103e9f3db58d17f.jpg)

Understanding Rent To Own Cars

How Do Auto Loans At A Car Dealership Work

5 Dealer Options To Skip When Buying A Car Bankrate

How To Sue A Car Dealer For Misrepresentation Findlaw

How To Convince The Dealership To Give You Its Lowest Auto Loan Rate Gobankingrates

Behind The Scenes At A Car Dealership Edmunds

No Haggle Pricing What You Need To Know About Lsquo Negotiaphobia Rsquo Capital One Auto Navigator

20 Questions You Need To Ask Your Car Dealer Before You Buy Gobankingrates

20 Questions You Need To Ask Your Car Dealer Before You Buy Gobankingrates